Problem Product Pitch and JTBD

Credable

Problem

The process of setting up a profile for financing involves an extensive underwriting procedure that typically takes around seven days, provided all the necessary data is readily available. However, data is often not readily accessible, and many businesses in rural India may lack the required documentation to secure financing. This results in considerable effort from both the sales and credit underwriting teams, who must chase down the necessary information. Ultimately, it often turns out that the client does not meet the eligibility criteria for funding. This lengthy and cumbersome process leads to many decisions being delayed, preventing the maximization of lead potential.

JTBD

Sales Team:

- Close deals with clients as quickly as possible.

Credit Team:

- Accurately assess risk and decide whether to approve the loan.

Product Team:

- Streamline the product to make the process smoother and integrate new features to enhance efficiency.

Key feature

- Cash flow Analysis

- Collateral Analysis

- Generate a CAM repor

Additional features

- Partening with recovery firms to train the ai module to understand the catagory of defaulters to catch them while screening them

Competitor

1.LEWAYHERTZ

2.Defi solutions

3.zest ai

4.SCIENAPTIC (NICE WEBSITE AND STORY)

Website Analysis

Discovery isn't very good the logo is incorrect website page not found the tag line should be more incentivising to the decision maker

Grammatical error and language change

Website ui does not reflects the company's offerings as an Ai platform

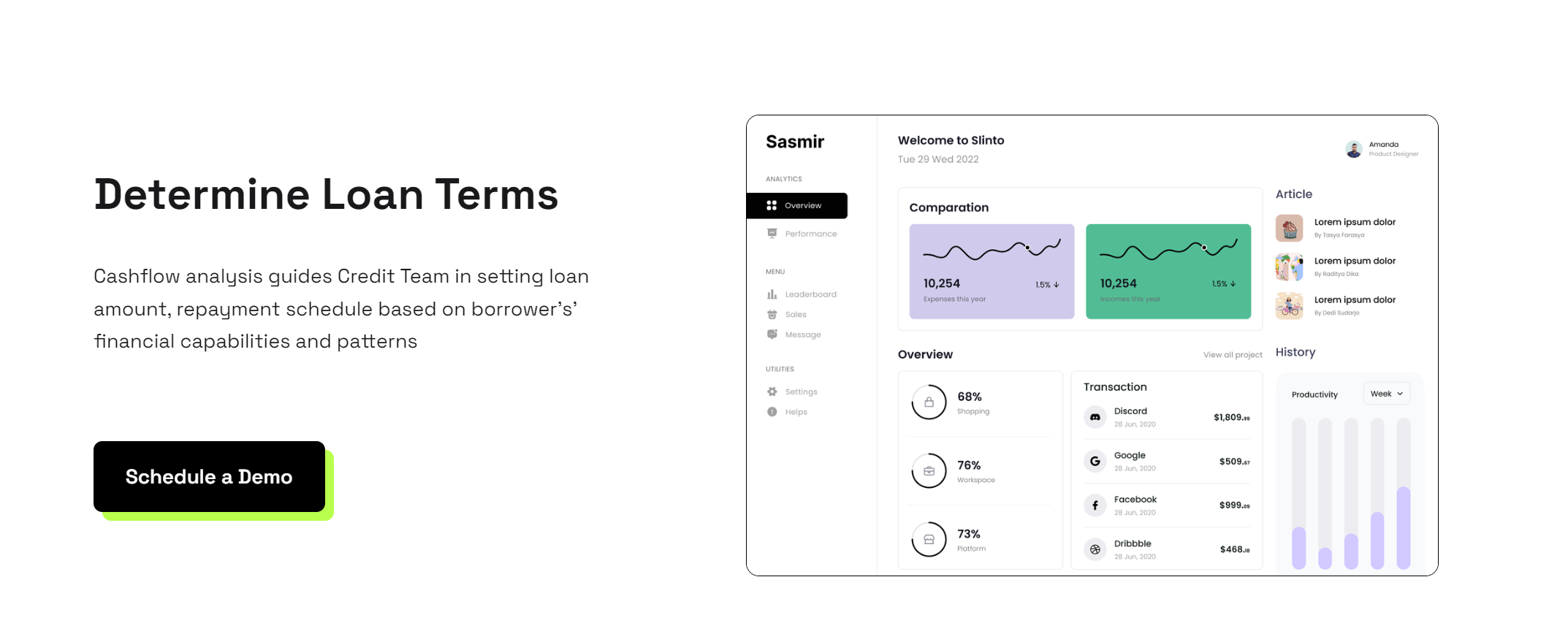

What is this photo showing what is welcome to sinto

ICP

| CREDIT MANAGER | RISK MANAGER | |

|---|---|---|---|

| |||

Current Pitch

-

Brand focused courses

Great brands aren't built on clicks. They're built on trust. Craft narratives that resonate, campaigns that stand out, and brands that last.

All courses

Master every lever of growth — from acquisition to retention, data to events. Pick a course, go deep, and apply it to your business right away.

Explore courses by GrowthX

Built by Leaders From Amazon, CRED, Zepto, Hindustan Unilever, Flipkart, paytm & more

Course

Advanced Growth Strategy

Core principles to distribution, user onboarding, retention & monetisation.

58 modules

21 hours

Course

Go to Market

Learn to implement lean, balanced & all out GTM strategies while getting stakeholder buy-in.

17 modules

1 hour

Course

Brand Led Growth

Design your brand wedge & implement it across every customer touchpoint.

15 modules

2 hours

Course

Event Led Growth

Design an end to end strategy to create events that drive revenue growth.

48 modules

1 hour

Course

Growth Model Design

Learn how to break down your North Star metric into actionable input levers and prioritise them.

9 modules

1 hour

Course

Building Growth Teams

Learn how to design your team blueprint, attract, hire & retain great talent

24 modules

1 hour

Course

Data Led Growth

Learn the science of RCA & experimentation design to drive real revenue impact.

12 modules

2 hours

Course

Email marketing

Learn how to set up email as a channel and build the 0 → 1 strategy for email marketing

12 modules

1 hour

Course

Partnership Led Growth

Design product integrations & channel partnerships to drive revenue impact.

27 modules

1 hour

Course

Tech for Growth

Learn to ship better products with engineering & take informed trade-offs.

14 modules

2 hours

Crack a new job or a promotion with ELEVATE

Designed for mid-senior & leadership roles across growth, product, marketing, strategy & business

Learning Resources

Browse 500+ case studies, articles & resources the learning resources that you won't find on the internet.

Patience—you’re about to be impressed.